In recent years, there has been a growing interest in a unique financial tool that allows seniors to achieve their dream of homeownership while enjoying the benefits of increased financial flexibility. We’re talking about the Reverse Mortgage Purchase, a concept that combines the advantages of a reverse mortgage with the aspiration of buying a new home.

This comprehensive guide covers everything from eligibility criteria to down payments, interest rates, and potential drawbacks.

What is a Reverse Mortgage Purchase?

A Reverse Mortgage Purchase is another type of reverse mortgage, also known as a Home Equity Conversion Mortgage for Purchase (HECM for Purchase). This financial product allows eligible seniors aged 62 or older to buy a new primary residence using a reverse mortgage.

Homeowners have the option to acquire their new home and secure the reverse mortgage in a single streamlined transaction, whether they aim to change locations or downsize. This program is versatile and can acquire various property types, including single-family homes, small multi-family homes, and condominiums. Eligible individuals may obtain a fixed-rate loan that can be used to purchase their new home.

Eligible Property Types for a Reverse Mortgage Purchase

Reverse mortgages are available for several property types, such as single-family homes, PUD–planned unit development, 2–4-unit dwellings, and HUD-approved condominiums. However, there are certain limitations to keep in mind.

To be eligible for a reverse mortgage, the property must be in a livable condition and not undergoing construction. Unfortunately, cooperative housing, boarding houses, and bed and breakfast establishments do not qualify for this mortgage type.

Additionally, newly constructed residences needing a Certificate of Occupancy are not eligible. In the case of manufactured homes, those constructed prior to 1976 or those failing to meet the Department of Housing and Urban Development standards are not suitable for a reverse mortgage for purchase.

In summary, it’s essential to understand that while a variety of property types can qualify for reverse mortgages, specific eligibility criteria must be met. Familiarizing oneself with these requirements empowers borrowers to make well-informed decisions and select the most suitable mortgage option for their needs.

Understanding Down Payments in Reverse Mortgage Purchases

Calculating the Down Payment

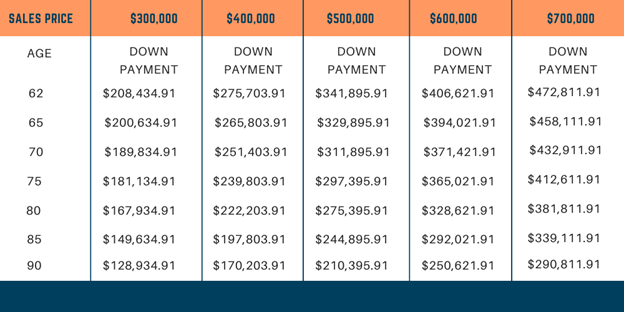

The amount of the down payment in a Reverse Mortgage Purchase is influenced by several factors, including the borrower’s age, the appraised value of the property, and current interest rates. Generally, the older the borrower and the higher the property value, the lower the required down payment.

Here’s the illustration:

Source: https://reverse.mortgage/

Sources of Down Payment Funds

Down payment funds can come from various sources, including the sale of a previous home, savings, or other acceptable sources. However, there may be restrictions on using borrowed funds for the down payment.

Comparing with Traditional Mortgage Down Payments

Compared to traditional mortgages, where borrowers often need to make substantial down payments, Reverse Mortgage Purchases can offer significant benefits, especially for seniors on a fixed income. It allows them to acquire a new home with a more manageable financial commitment.

Interest Rates and Costs

Rate Structures

Borrowers can choose between fixed and variable interest rates for their Reverse Mortgage Purchase. Fixed rates provide stability, while variable rates may offer lower initial costs but carry some risk.

Average Rates Comparison

On average, interest rates for Reverse Mortgage Purchases may differ from those of traditional mortgages. Understanding these differences and how they impact the overall cost of homeownership is crucial.

Other Costs and Fees

Like any mortgage transaction, Reverse Mortgage Purchases may involve closing costs, servicing fees, and mortgage insurance premiums. It’s essential to be aware of these costs and factor them into your financial planning.

Benefits of a Reverse Mortgage Purchase

Now that we’ve covered the technicalities, let’s explore the benefits of opting for a Reverse Mortgage Purchase:

No Monthly Mortgage Payments

One of the most appealing aspects of a Reverse Mortgage Purchase is that it eliminates the need for monthly mortgage payments. Instead, borrowers repay the loan when they leave the home. It offers financial relief to retirees and enables them to enjoy a more comfortable retirement.

Simplified Home Buying Process

With a Reverse Mortgage Purchase, the home purchase and financing are combined into a single transaction, streamlining the process and reducing paperwork.

Financial Flexibility

Reverse mortgages provide borrowers with the freedom to choose how they receive their funds, whether through a lump sum, a line of credit, monthly payments, or a combination of these options. This enables borrowers to tailor their loans to suit their individual financial requirements.

Non-Recourse Feature

The HECM for Purchase, similar to all HECM loans, includes a non-recourse provision. It means that when the loan becomes due, the borrower is not obligated to repay an amount exceeding the current value of the home upon its sale. This safeguards both the borrower and their heirs.

Ownership

Homeowners retain ownership of their home and can reside in it indefinitely as long as they meet loan requirements, which include paying property taxes and maintaining the property. This affords a sense of assurance and stability to borrowers and their families.

Seniors can utilize the equity from the sale of their previous home without tying up that capital in their new property. This can provide greater financial flexibility during retirement.

Potential Drawbacks to Consider

While Reverse Mortgage Purchases offer many advantages, it’s essential to be aware of potential drawbacks:

1. Impact on Heirs and Estate

When a borrower passes away, their heirs might inherit a diminished share of home equity because it may necessitate the sale of the property to settle the outstanding loan balance. It could have an impact on the planned inheritance for their loved ones.

2. Longer-Term Financial Implications

Participating in a Reverse Mortgage Purchase might affect future eligibility for certain types of assistance or benefits, so careful consideration is needed.

3. The Risk of Foreclosure

In some situations, borrowers could face foreclosure if they fail to meet their obligations, such as property taxes and insurance payments.

Conclusion

In summary, a Reverse Mortgage Purchase presents a unique opportunity for seniors to realize their homeownership aspirations while enjoying financial flexibility. Individuals can make informed decisions that align with their needs and goals by understanding eligibility criteria, down payment considerations, interest rates, and potential drawbacks. Evaluating the benefits and potential downsides to make the best choice for your circumstances when considering a Reverse Mortgage Purchase is crucial.