The Federal Housing Administration (FHA) plays a pivotal role in aiding prospective homeowners, especially those in unique housing markets like Hawaii. Yearly loan limits set by the FHA are crucial to understand, as these figures can significantly impact purchasing decisions.

FHA loans provide a more inclusive mortgage solution for many individuals. They offer more leniency than conventional options, facilitating approval for those facing challenges in this domain. However, the loan amount you’re eligible for varies yearly and is also influenced by your location. For those considering an FHA loan, it’s essential to be informed about the 2023 FHA loan limits. Let’s delve deeper into this.

Background on FHA Loans

The Federal Housing Administration(FHA) is a branch of the U.S. Department of Housing and Urban Development (HUD). Established in 1934, the FHA’s primary objective is to stabilize the mortgage market, improve housing standards, and provide an adequate home financing system through insuring loans.

Key benefits and characteristics of FHA loans:

- Low down payments (typically 3.5% for borrowers with a credit score of 580 or higher).

- More lenient credit requirements.

- Competitive interest rates.

- Available to all qualified buyers, not just first-time homeowners.

Why FHA Loan Hawaii Limits Are Unique?

Hawaii boasts a distinct housing landscape marked by its high median home prices and limited land availability. Due to its insular nature and robust demand, real estate prices have always been higher than most parts of the mainland U.S.

Historically, the FHA has recognized these disparities, setting Hawaii’s FHA loan limits at a higher threshold than much of the mainland U.S.

FHA Loan Hawaii Limits for 2023

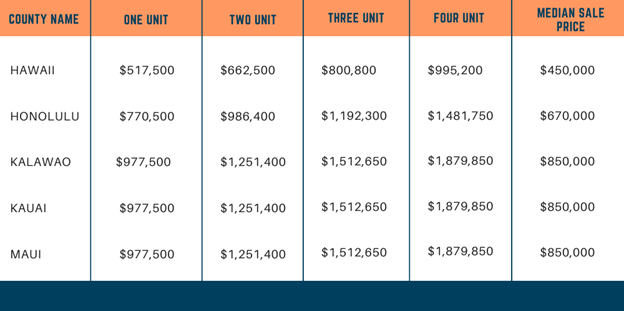

For those seeking a home in Hawaii, 2023 increases borrowing potential, as FHA loan limits for a single-family residence range from $517,500 to $977,500. This is particularly beneficial if you’re considering settling in places like Kauai or Maui, where the median sales price for a one-unit home reached a peak of $850,000 the previous year.

Hawaii FHA loan limits by county

* To find the ceiling and floor in your county, you can search for it using HUD’s FHA mortgage limits page.

How to qualify for an FHA loan in Hawaii

FHA loans often appeal to purchasers who might not qualify for standard loans. With the increased FHA loan limits in Hawaii for 2023, individuals with less-than-stellar credit and a mere 3.5% down payment might find homeownership within reach, especially given that the average home prices fluctuated between $450,000 and $850,000 in the recent year.

To secure an FHA loan in Hawaii, buyers must satisfy the following criteria:

- Down Payment and Credit Score: Typically, for FHA loans, a minimum down payment of 3.5% of the purchase price is required. However, this applies to borrowers with credit scores of 580 and above.If your credit score falls between 500 and 579, you might still qualify, but you’ll likely need to put down 10%. While FHA loans can cater to those with lower credit scores, lenders might have credit score requirements that can be stricter.

- Debt-to-Income (DTI): Your DTI ratio measures your monthly debt payments relative to your gross monthly income. While the exact threshold can vary, most lenders prefer a DTI ratio below 43%. This ensures that borrowers are taking on only what they can realistically handle.

- Mortgage Insurance: One distinctive feature of FHA loans is the requirement for two types of mortgage insurance:

- Upfront Mortgage Insurance Premium (UFMIP): This is typically 1.75% of the loan amount and can be paid upfront or rolled into the loan.

- Annual Mortgage Insurance Premium (MIP): This is an ongoing monthly charge, calculated annually, and its rate can vary based on the loan’s term and loan-to-value ratio.

- Occupancy: FHA loans are designed for primary residences, not investment properties or vacation homes. This means borrowers must live in the financed property as their primary residence.

- FHA Home Appraisal: Before your loan is approved, an FHA-approved appraiser must appraise the property in question. The objective is to ensure the home meets specific safety, security, and soundness standards. If the property fails to meet these criteria, it might not qualify, or certain repairs may be mandated before the loan is approved.

Factors Influencing the 2023 FHA Loan Hawaii Limits

The 2023 FHA Loan limits in Hawaii are influenced by a mix of local and national factors. The primary driver is Hawaii’s median home price, adjusting the limits to match the real estate market’s current state.

The broader U.S. economic climate, including aspects like inflation and employment, also plays a role, as do Hawaii-specific economic conditions, such as local employment and tourism trends. Previous loan limit decisions and their results further shape the new limits.

In short, these limits reflect the interplay between Hawaii’s housing market, the national economy, and Hawaii’s unique economic scenario.

Conclusion

The Federal Housing Administration (FHA) significantly facilitates homeownership, especially in unique markets like Hawaii. Established in 1934, the FHA aims to stabilize the mortgage market and ensure loans to promote homeownership.

Hawaii’s housing market, characterized by high median prices and limited land, necessitates unique FHA loan limits, which in 2023 range from $517,500 to $977,500 for a single-family home. These limits are determined based on Hawaii’s median home prices, the broader U.S. economic climate, and Hawaii’s particular economic conditions.

Potential homeowners should be aware of these limits, the benefits of FHA loans, and the criteria for qualification to make informed decisions in their home purchasing journey in Hawaii.

FHA Loan Hawaii Limits 2023

The Federal Housing Administration (FHA) plays an important role in aiding prospective homeowners, especially those in unique housing markets like Hawaii. Yearly loan limits set by the FHA are crucial to understand, as these figures can significantly impact purchasing decisions.

FHA loans provide a more inclusive mortgage solution for many individuals. They offer more leniency than conventional options, facilitating approval for those facing challenges in this domain. However, the loan amount you’re eligible for varies yearly and is also influenced by your location.

For those considering an FHA loan, it’s essential to be informed about the 2023 FHA loan limits.

Background on FHA Loans

The Federal Housing Administration(FHA) is a branch of the U.S. Department of Housing and Urban Development (HUD). FHA was established in 1934. The FHA’s primary objective is to stabilize the mortgage market, improve housing standards, and provide an adequate home financing system through insuring loans.

Key benefits and characteristics of FHA loans:

- Low down payments (typically 3.5% for borrowers with a credit score of 580 or higher).

- More lenient credit requirements.

- Competitive interest rates.

- Available to all qualified buyers, not just first-time homeowners.

Why FHA Loan Hawaii Limits Are Unique?

Hawaii boasts a distinct housing landscape marked by its high median home prices and limited land availability. Due to its insular nature and robust demand, real estate prices have always been higher than most parts of the mainland U.S.

Historically, the FHA has recognized these disparities, setting Hawaii’s FHA loan limits at a higher threshold than much of the mainland U.S.

FHA Loan Hawaii Limits for 2023

For those seeking a home in Hawaii, 2023 increases borrowing potential, as FHA loan limits for a single-family residence range from $517,500 to $977,500. This is particularly beneficial if you’re considering settling in places like Kauai or Maui, where the median sales price for a one-unit home reached a peak of $850,000 the previous year.

Hawaii FHA Loan Limits By County

While there are common limits, your own FHA loan limit may be different. That’s because FHA loan limits are set based on county property values, so they vary by location. To find the ceiling and floor in your county, you can search for it using HUD’s FHA mortgage limits page.

How to qualify for an FHA loan in Hawaii

FHA loans often appeal to purchasers who might not qualify for standard loans. With the increased FHA loan limits in Hawaii for 2023, individuals with less-than-stellar credit and a mere 3.5% down payment might find homeownership within reach, especially given that the average home prices fluctuated between $450,000 and $850,000 in the recent year.

To secure an FHA loan in Hawaii, buyers must satisfy the following criteria:

- Down Payment and Credit Score: Typically, for FHA loans, a minimum down payment of 3.5% of the purchase price is required. However, this applies to borrowers with credit scores of 580 and above. If your credit score falls between 500 and 579, you might still qualify but likely need to put down 10%. While FHA loans can cater to those with lower credit scores, lenders might have credit score requirements that can be stricter.

- Debt-to-Income (DTI): Your DTI ratio measures your monthly debt payments relative to your gross monthly income. While the exact threshold can vary, most lenders prefer a DTI ratio below 43%. This ensures that borrowers are taking on only what they can realistically handle.

- Mortgage Insurance: One distinctive feature of FHA loans is the requirement for two types of mortgage insurance:

- Upfront Mortgage Insurance Premium (UFMIP): This is typically 1.75% of the loan amount and can be paid upfront or rolled into the loan.

- Annual Mortgage Insurance Premium (MIP): This is an ongoing monthly charge, calculated annually, and its rate can vary based on the loan’s term and loan-to-value ratio.

- Occupancy: FHA loans are designed for primary residences, not investment properties or vacation homes. This means borrowers must live in the financed property as their primary residence.

- FHA Home Appraisal: An FHA-approved appraiser must appraise the property in question before your loan is approved. The objective is to ensure the home meets specific safety, security, and soundness standards. If the property fails to meet these criteria, it might not qualify, or certain repairs may be mandated before the loan is approved.

Factors Influencing the 2023 FHA Loan Hawaii Limits

A mix of local and national factors influences Hawaii’s 2023 FHA Loan limits. The primary driver is Hawaii’s median home price, adjusting the limits to match the real estate market’s current state.

The broader U.S. economic climate, including aspects like inflation and employment, also plays a role, as do Hawaii-specific economic conditions, such as local employment and tourism trends. Previous loan limit decisions and their results further shape the new limits.

In short, these limits reflect the interplay between Hawaii’s housing market, the national economy, and Hawaii’s unique economic scenario.

Conclusion

The Federal Housing Administration (FHA) significantly facilitates homeownership, especially in unique markets like Hawaii. Established in 1934, the FHA aims to stabilize the mortgage market and ensure loans to promote homeownership. Hawaii’s housing market, characterized by high median prices and limited land, necessitates unique FHA loan limits, which in 2023 range from $517,500 to $977,500 for a single-family home.

These limits are determined based on Hawaii’s median home prices, the broader U.S. economic climate, and Hawaii’s particular economic conditions. Potential homeowners should be aware of these limits, the benefits of FHA loans, and the criteria for qualification to make informed decisions in their home purchasing journey in Hawaii.